Executive Officer in Charge of Finance - Commitment

Our Solid Financial Strategy to Support Food Sustainability

Review of Fiscal 2023 Results

In fiscal 2023, Japan’s economy gradually recovered, in part because the COVID-19 pandemic was subsiding. However, the economy stalled slightly in the second half of the year.

In the food industry, there was an increase in demand in the food service industry due to an increase in inbound demand, which was a positive factor. On the other hand, raw material and energy prices continued to spike around the world, and price increases continued for food and other products. This had an impact on consumer behavior. In addition, there were further cost increases due to problems related to lack of transport capacity anticipated to hit Japan within 2024 and the further depreciation of the yen, among other factors.

In this environment, the Group delivered higher sales and profits. In the Group Medium-Term Management Plan 2025, we have set a target of 20 billion yen in operating profit for the final year. Recording 18.4 billion yen in operating profit in the current fiscal year gives us a solid start on our target for the final year of the plan, fiscal 2025.

The effects of price increases have been effective in addressing higher costs, and they have helped to restore profits. We believe that the new prices represent customers’ recognition of the value of the Group’s products, and we have demonstrated a certain degree of resilience to higher costs. The price changes made in fiscal 2023 have almost covered the cost increases of the past two years. On the other hand, data on sales volume shows some products where growth is sluggish, so improving volume is a challenge we need to address in the future. Even so, sales of Sakeru Cheese, for which we expanded production capacity, increased by double digits compared to the previous fiscal year. In addition, in the beverages and desserts category, sales of milk-based beverages such as Mainichi Honebuto and MBP Drink were strong, achieving double-digit growth compared to the previous fiscal year. We will continue to actively expand these products in the future.

We have set a target of 19 billion yen in operating profit for fiscal 2024, and we plan to achieve this by increasing sales volume through promotions and other means.

Progress on the Group Medium-Term Management Plan 2025

- Progress with Business Strategies

Our company will celebrate its 100th anniversary in 2025. We have designated the Group Medium-Term Management Plan 2025 as a period to build a foundation for the next 100 years. It is a plan for the corporate Group to gain resilience, that is, to build a strong business structure and the robust foundation essential for growth. As mentioned earlier, we are aiming for operating profit of 20 billion yen in fiscal 2025. Our ROE target is 6% or more, but we will aim for 8% or more as soon as possible after the end of the Group Medium-Term Management Plan 2025.

Our business strategy is supported by three pillars: cultivating new seeds for growth, increasing volume through the utilization of the existing foundation, and strengthening and supporting the domestic base of dairy farming production. We are also working on six strategic themes. So far, we have made steady progress in areas that could become drivers of growth, such as launching new plant-based food products, starting construction of a plant-based food ingredient production plant in Malaysia to be operated by Agro Snow, expanding the overseas deployment of functional ingredients, making Yoshida Corporation a subsidiary, and establishing a local cheese production company in Vietnam.

- Progress on Financial Strategy

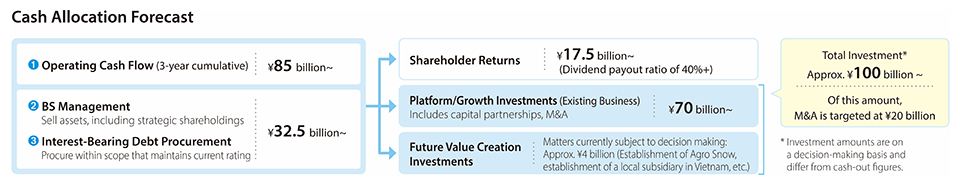

As part of the financial strategy in the Group Medium-Term Management Plan 2025, we will maintain a sound financial position while actively investing in infrastructure and growth areas using operating cash flow and asset reductions as funding sources. At the same time, we will provide stable shareholder returns with a target dividend payout ratio (excluding gains on sales of assets) of 40% or more.

In fiscal 2023, the level of ROE excluding gains on sales of assets was in the 5-6% range due to the recovery in operating profit, and we believe that we are making steady progress toward achieving the 6% target in fiscal 2025, the final year of the plan. The equity ratio was 53.8%, exceeding the target of 50% for the second consecutive year. This shows that our financial position has grown even more sound, and we believe that we have reached a stage at which we can actively take on the challenges of investing for growth, or in other words, cultivating new seeds for growth, one of the pillars of the Group Medium-Term Management Plan 2025.

In terms of shareholder returns, we have increased dividends by 20 yen per share to 80 yen, taking into account a variety of factors, including the improvement in consolidated financial results and the more sound financial position. Based on our current financial situation, we have changed our dividend payout ratio target from 30% to 40% or more for fiscal 2024, excluding gains on the sale of assets. Furthermore, in anticipation of our 100th anniversary, we are planning to pay a commemorative dividend of 20 yen to express our gratitude to our shareholders, so we forecast a dividend of 100 yen in total, including the ordinary dividend. As part of our efforts to improve the efficiency of our assets, we are also reducing the number of shares we hold as strategic investments. The cash generated from this will be used in principle to make solid investments for growth, and we will use this to drive further growth. However, if the cash generated from the sale of these shares exceeds the Group’s growth investments, our policy of returning this to our shareholders will not change.

We are also reviewing our cash allocation in light of the increase in cash inflows from these earnings and the sale of assets and the increase in shareholder returns. With regard to the total amount of investment during the period of the Group Medium- Term Management Plan 2025, we are aiming to allocate a total of 100 billion yen to base and growth investment targeting existing businesses, and future value creation investment targeting new businesses. Of this, 20 billion yen will be allocated to M&As, with the aim of accelerating growth. Future value creation investments are investments in areas that will become new growth drivers for our Group. We will continue to invest in the plant-based food area, as already underway, as well as in fostering function-added foods and enhancing our overseas development.

- Key Themes

The Group operates its business with a focus on two standards: increasing the profitability and growth potential of our business and contributing to food sustainability, especially in the domestic dairy industry. We believe that contributing to sustainable dairy farming will reliably lead to an increase in our corporate value in the long run, and we intend to continue our dialogue with our stakeholders until they understand this point.

Management with an Awareness of Capital Efficiency

In terms of our share price valuation, we recognize that it is problematic that our PBR is below 1. We believe that the main reasons for this are factors keeping profitability down and the fact that we have not yet fully executed our specific initiatives for future growth strategies and our capital policy.

We aim to achieve a PBR of more than 1 as soon as possible by taking specific actions to address issues such as reaching an ROE of 8% or more, and communicating better with our shareholders to earn high praise.

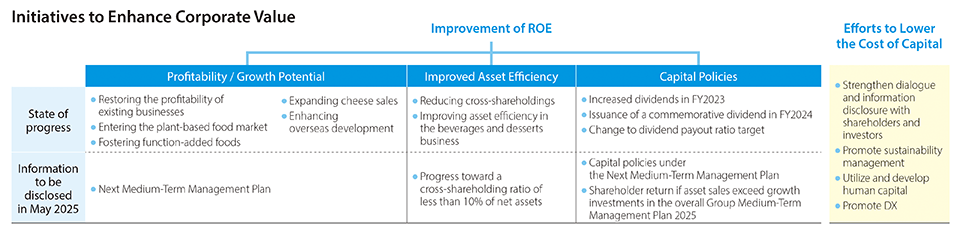

- Improving ROE

1. Improving Profitability and Growth Potential

In existing businesses, the effects of price revisions and other measures taken to date have absorbed the impact of higher costs, and profitability is steadily recovering. With these steps, we believe that we have demonstrated a certain degree of resilience to higher costs. We will firmly implement measures to improve profitability in businesses that are facing challenges. In terms of improving growth, we will steadily implement our plan to drive growth with plant-based foods and other alternative foods, function-added foods, cheese, and overseas development.

2. Improving Asset Efficiency

As a result of the reduction in cross-shareholdings currently underway, the percentage of net assets to total assets in fiscal 2023 decreased by 1.9% from the previous year to 17.9%, and the number of stocks held decreased by 14 to 53. We will continue to reduce the value of shares held to less than 10% of net assets by the end of fiscal 2025. In the Beverages and Desserts Business, the site of the Nagoya Plant, which was integrated with the Toyohashi Plant to improve asset efficiency and ceased production, was sold in April 2024.

3. Capital Policies

As I have already mentioned, in fiscal 2023 we plan to increase the dividend by 20 yen per share, and in fiscal 2024 we plan to add a 100th anniversary commemorative dividend (20 yen per share), bringing the dividend per share to 100 yen.

We have also started to formulate a new management plan. In this plan, we will consider the capital policy for the next management plan and the return of profits to shareholders from the sale of assets in the Group Medium-Term Management Plan 2025. We plan to disclose this in May 2025.

- Lowering Cost of Capital

We will reduce cost of capital by strengthening dialogue with stakeholders, including shareholders and investors, and by enhancing information disclosure, including not only financial information but also information on our efforts to improve sustainability, utilize human capital, and promote DX.

Steps to Increase Corporate Value

In order to help achieve food sustainability, we will increase growth, profitability and capital efficiency while maintaining financial soundness, and direct the funds obtained through our business toward investment in new growth and the enhancement of shareholder returns. Guiding these efforts is my most important mission as the executive officer responsible for finance. You can expect the Group’s financial strategy to achieve great results as we work to continuously improve corporate value.