Executive Officer in Charge of Finance - Commitment

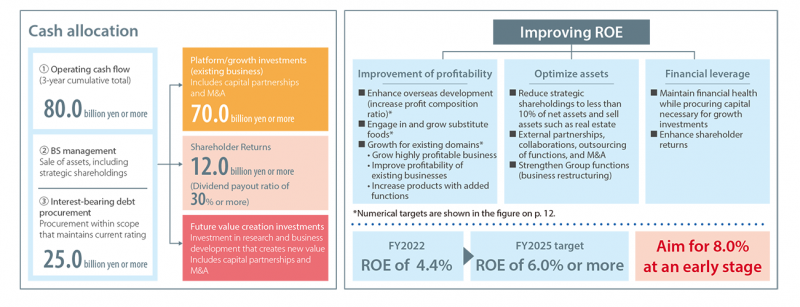

Under the basic policy of maintaining nancial stability, investing in our platform and growth areas by reducing assets, and providing stable shareholder returns, we will implement nancial strategies to realize the Group Medium-Term Management Plan 2025, aiming to achieve ROE of 6.0% or higher and 8.0% or higher as soon as possible.

Fiscal 2022 results and future issues

Review of the management metrics and performance

Fiscal 2022 was the second stage of the Group Long-Term Vision 2026 and the final fiscal year of the Group Medium-Term Management Plan 2022.

The external environment has changed drastically since the plan was formulated, including effects from the drop in demand due to COVID-19 and global cost increases due to the situation in Russia and Ukraine. Due to these and other factors, our financial results for fiscal 2022 were net sales of 584.3 billion yen, operating profit of 13.0 billion yen, ordinary profit of 14.4 billion yen, and profit attributable to owners of the parent of 9.1 billion yen, meaning we had increases in sales and declining profits.

The Group Medium-Term Management Plan 2022 consolidated management metrics comprise return on equity (ROE) of 8% or more, equity ratio of 50% or more, interest-bearing debt of 78.0 billion yen or less, and a dividend payout ratio of 20-30%. As a result, although ROE did not reach the target of 4.4%, the equity ratio rose 0.4% from the end of the previous fiscal year to 51.9%, and interest bearing debt totaled 69.8 billion yen.

In addition, we issued the Group’s first green bonds as a way of raising funds that incorporates a sustainability perspective. We assess that flexibly raising funds as needed has contributed to the improvement of our financial health.

With regard to shareholder returns, because the equity ratio reached more than 50% in fiscal 2021, in accordance with our

announced policy, we enhanced shareholder returns ahead of schedule by increasing the dividend payout ratio to more than

30% as well as increasing the previous 40 yen dividend per share by 20 yen to reach 60 yen. In fiscal 2022, we will continue to pay a

dividend of 60 yen, bringing the dividend payout ratio to 44.4%.

Issues facing the Group

We were unable to fully reap the benefits of the production system improvements promoted under the Group Medium-Term Management Plan 2022 because we were unable to expand sales volume. In addition, although we were able to create new value through efforts such as the launch of MBP Drink and other highvalue-added products, collaboration with other companies, and R&D initiatives, we were not able to raise the sales mix to what we targeted. We believe that we were unable to capture changes in the market environment and lifestyles, which caused our profitability to decline as a result, and we recognize that further gaining resilience is an issue.

Moreover, in addition to the decline in ROE due to our profitability not reaching the target level, we believe that our inability to present to our stakeholders a roadmap for the Group’s growth has led to the current weak stock price and PBR below 1. In response to this issue, we have positioned “Creating seeds for new growth,” “Expanding quantity by utilizing our platform,” and “Strengthening and supporting the domestic dairy farming production platform” as our business strategies under the theme of “Gain resilience” in the Group Medium-Term Management Plan 2025.

We will show the Group’s growth through the initiatives of these three business strategies, and by putting them into practice, we aim to improve profitability and asset efficiency and thereby enhance our corporate value and stock price. We will also aim to achieve ROE of 8% and PBR of more than 1 at an early stage.

Fiscal 2022 results and future issues

Basic policies and management metrics

Toward the realization of the Group Medium-Term Management Plan 2025, while maintaining its financial stability, the Group will increase profitability by investing the cash generated from asset sales in core businesses, growth areas, and new value creation, and provide stable shareholder returns.

Our management metrics for fiscal 2025 are net sales of 665.0 billion yen, operating profit of 20.0 billion yen, profit of 14.0 billion yen, EBITDA of 38.5 billion yen, equity ratio of 50%, debt-to-equity ratio (D/E ratio) of 0.5 or less, dividend payout ratio of 30% or more, and ROE of 6.0% or more.

Cash allocation & ROE improvement

In addition to our plan to generate operating cash flow of more than 80.0 billion yen in total over the three-year period from 2023 to 2025, we plan to raise a total of more than 25.0 billion yen by selling assets through BS (Balance Sheet) management and interest-bearing debt procurement while maintaining financial discipline. Moreover, as one of the initiatives to improve asset efficiency through BS management, the Group will gradually reduce its strategic shareholdings to less than 10% of net assets through dialogue with business partners.

We plan to use the funds obtained from the above creation and procurement to invest more than 70.0 billion yen in “platform/ growth investments.” We also plan to invest in R&D and business development to create new value, or “future value creation investments.” In May 2023, as part of our entry into the plant-based food business, we established a joint venture company (Agro Snow Pte Ltd) with Agrocorp, a grain trading company in Singapore. We will continue to actively engage in investments that create new value.

By allocating capital generated through BS management initiatives to growth investments, we will improve asset efficiency and profitability, aiming for an ROE of at least 6.0% in fiscal 2025 and 8.0% or higher thereafter at an early stage.

With regard to growth investments, we are conscious of the cost of capital and make individual investment decisions based on both profitability and capital efficiency.

With regard to shareholder returns, we plan to allocate at least 12.0 billion yen while maintaining a dividend payout ratio of at least 30%.

Toward the next 100 years

The Group Medium-Term Management Plan 2025 is positioned as a period for laying the foundation for growth toward the next 100 years. For achieving the theme of “gain resilience,” we will support the enhancement of corporate value from the financial side by considering and implementing a balance of maintaining financial stability, investing in platform and growth areas by reducing assets, and implementing stable shareholder returns.